Rate Cuts Won't Save Jobs

Summary

The Federal Reserve will cut interest rates in September, but meaningful relief won’t come in time. August produced just 22,000 jobs, unemployment rose to 4.3%, and structural layoffs are surging—tech alone cut 89,251 jobs, 36% more than last year. Small businesses report no credit access, construction is already shrinking, and September’s revisions will erase 911,000 “phantom jobs.”

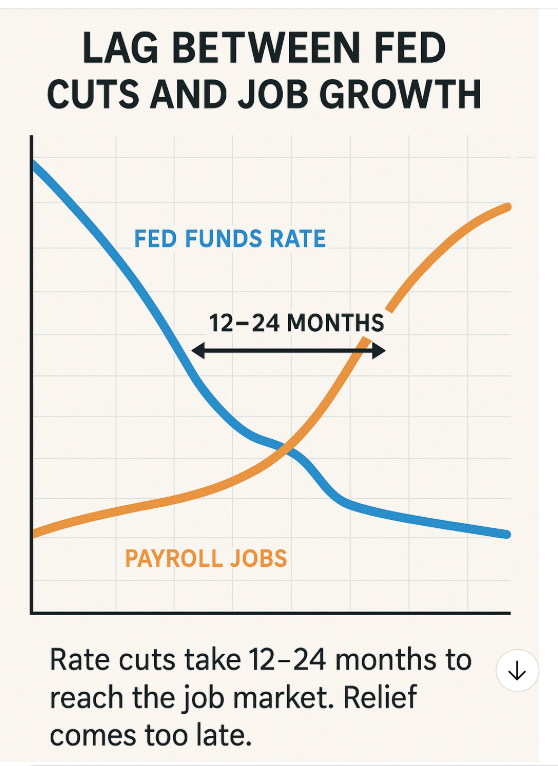

Rate cuts take 12–24 months to filter through. By then, millions more will have been laid off. Markets may rally, but the real economy is stuck in managed decline: slower bleeding, not recovery.

The cure doesn’t exist—only morphine for the pain.

The Fed’s Magic Trick That Isn’t

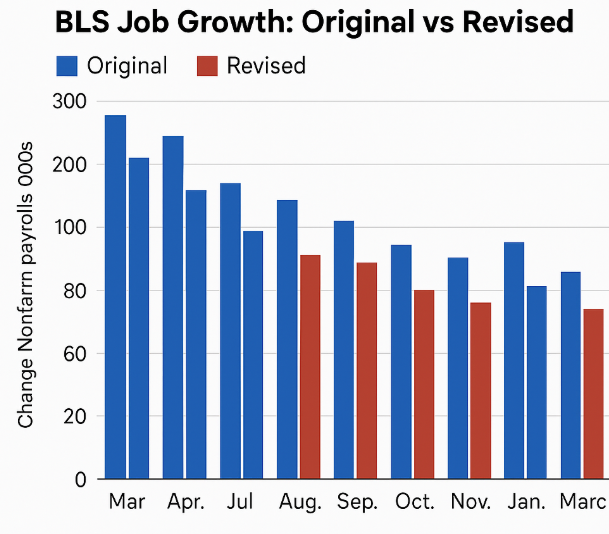

They’ll cut rates. Of course they will, Trump insists. The August jobs report came in at 22,000—less than a third of the already-pathetic 75,000 forecast. Unemployment hit 4.3%, the highest since the plague years. For the first time since COVID, we actually lost jobs in June.

Thirteen thousand pink slips—while economists still argued about “soft landings.”

The Fed’s September meeting is already priced in: 87.8% probability of a quarter-point cut.

Some whisper about a half-point panic move—as if fifty basis points could resurrect what’s already decomposing.

Here’s what they won’t tell you:

Rate cuts are morphine for a dying patient. They dull the pain. They don’t cure the disease.

The Broken Transmission

The machinery connecting Fed policy to actual hiring has been stripped for parts.

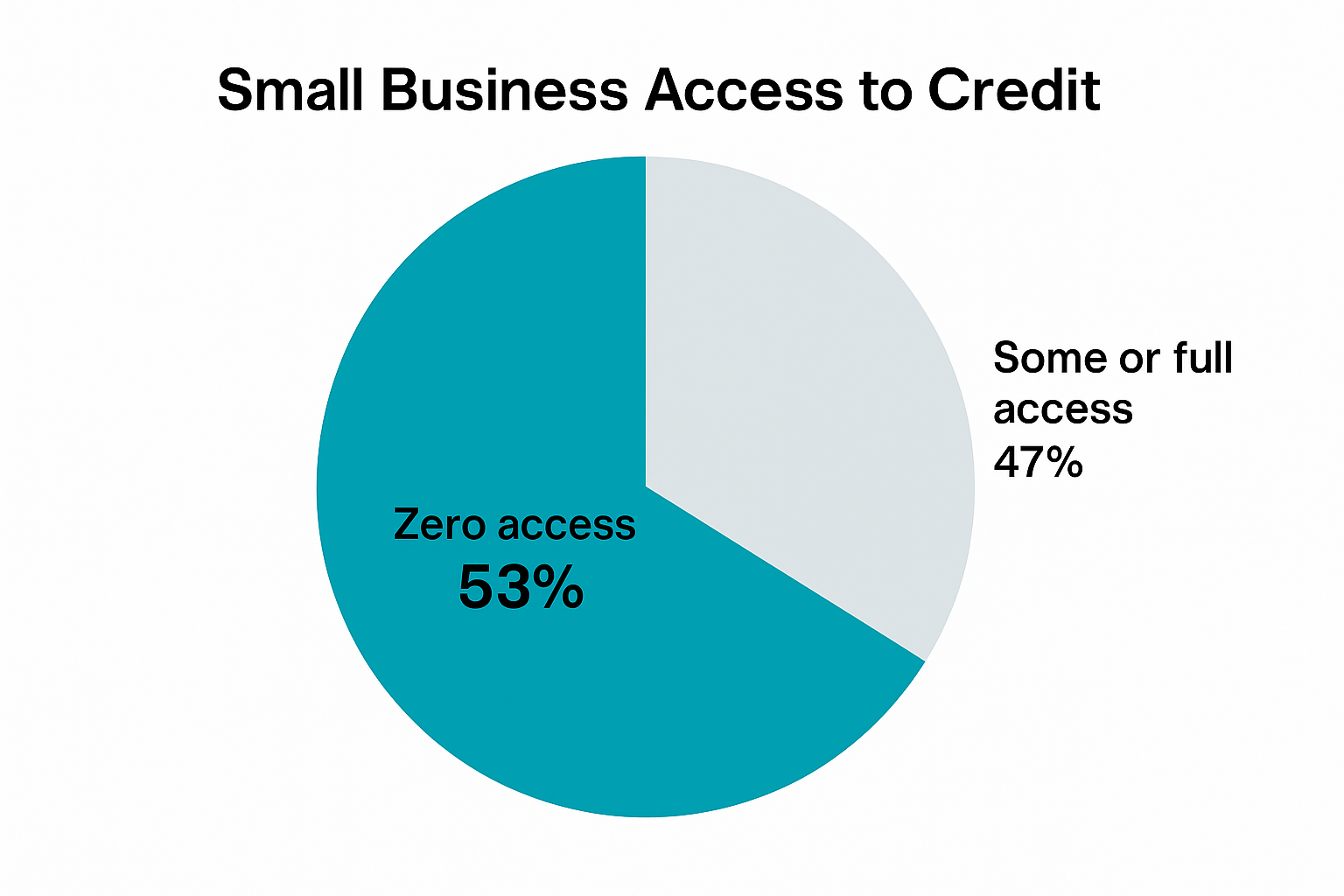

Small businesses—the ones that actually create jobs—won’t feel a September rate cut until mid-2026.

That’s not speculation. That’s history.

Monetary policy takes 12–24 months to work through the system.

Meanwhile, 53% of small businesses report zero access to credit.

You can cut rates to negative territory—and it won’t matter if the bank won’t open the vault.

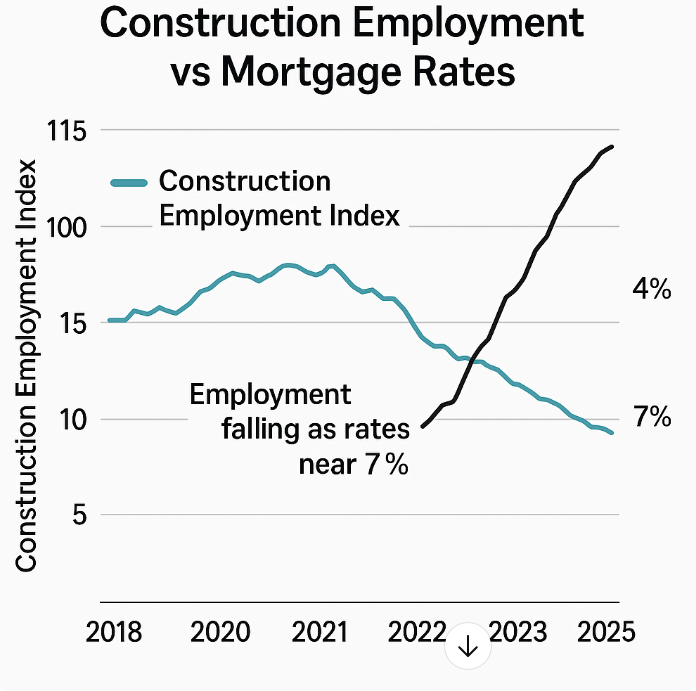

Construction’s Corpse

Lower rates should mean cheaper mortgages, more building, more jobs.

That’s the textbook.

The reality: construction is already laying off.

The industry needs 454,000 new workers to meet demand—but can’t afford to hire at today’s rates.

And won’t at slightly lower ones either.

The math is brutal: projects are gone now. Rate cuts won’t conjure them back for at least a year.

The Corporate Bloodletting

While the Fed fiddles, corporate America cuts.

Tech alone axed 89,251 jobs through July—36% more than last year.

Intel’s slashing 24,000. Paramount’s prepping 3,000.

These aren’t cyclical cuts.

They’re structural.

AI-enabled redundancies. Jobs not coming back.

In August, companies announced 86,000 cuts—the worst August since 2020, when the economy was literally shut down.

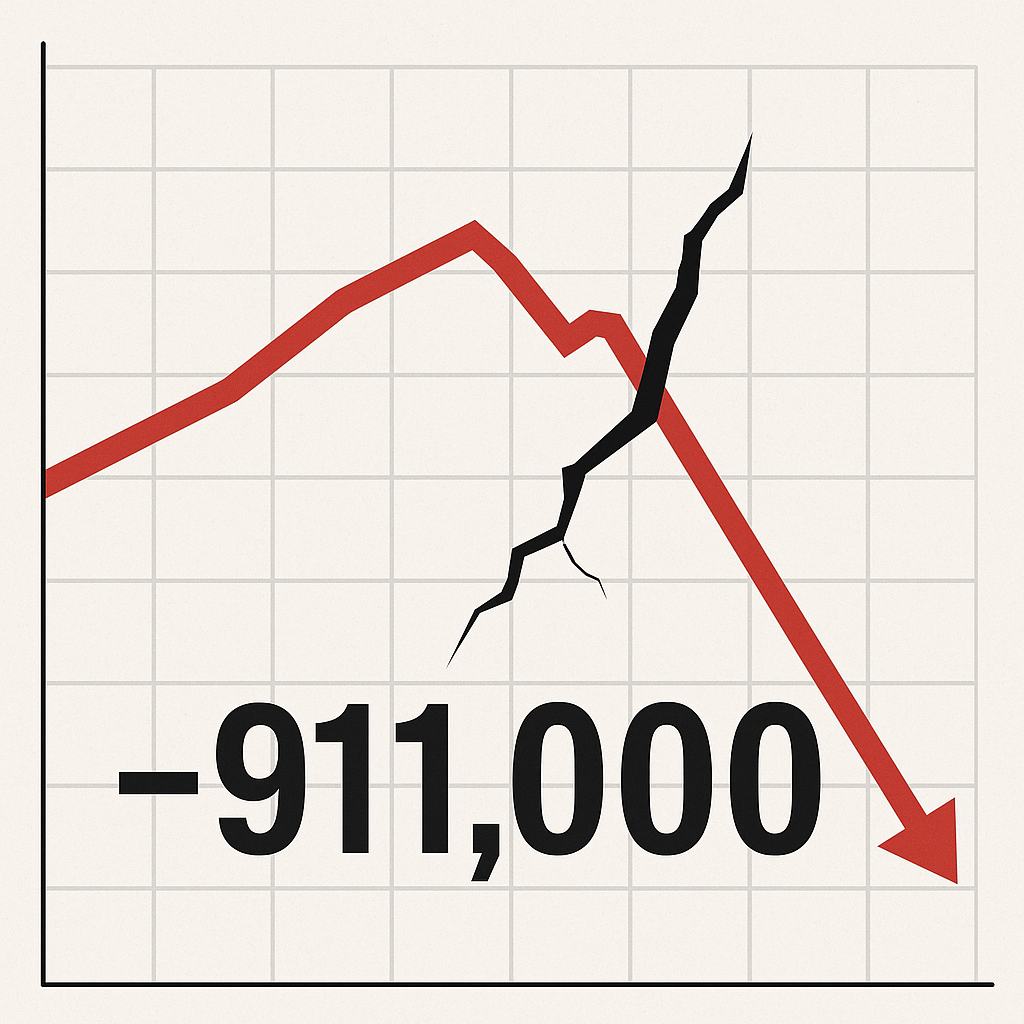

The Phantom Jobs

The kicker: we’ve been cheering ghosts.

Benchmark revisions due September 9th are expected to erase 911,000 jobs from the last twelve months.

That’s 65,000 jobs a month that never existed.

We’ve been driving with a broken speedometer—about to hit the wall slower, and weaker, than anyone thought.

The Timeline of False Hope

What really happens after a rate cut:

- Months 0–3: Nothing. Banks pocket the spread.

- Months 4–6: A trickle of refinancing. No hiring.

- Months 7–12: Construction stirs. Maybe 20,000 jobs a month.

- After 12 months: Small businesses finally see credit—if they survived that long.

That’s the best case.

If no recession hits.

If no black swan arrives.

The Political Circus

Trump plays reality show host with the Fed—declaring governors fired, threatening Powell, demanding rates cut to zero yesterday.

The Fed’s trapped between economic decay and political theater.

Cut too little, and the economy cracks while Trump screams incompetence.

Cut too much, and inflation roars back—giving him new ammunition.

Either way, the patient flatlines while someone keeps bumping the table.

The Bottom Line

Rate cuts will help. Eventually. Maybe.

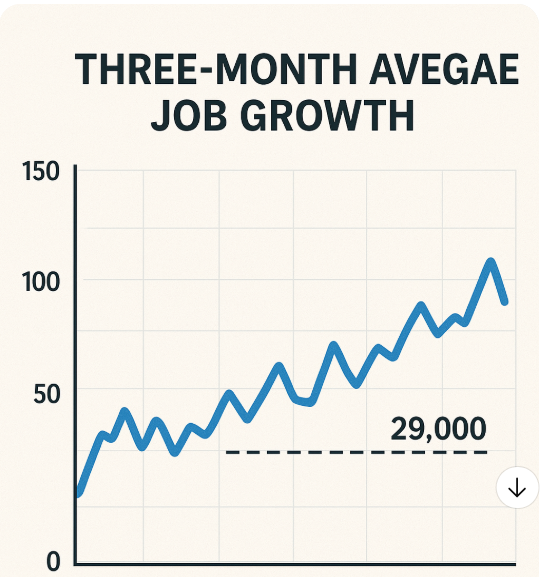

We might see 50,000 to 100,000 jobs/month—by late 2026.

Two years from now.

Between now and then? The question isn’t recovery.

It’s triage:

- Do we lose 50,000 jobs a month, or 150,000?

- Does unemployment climb to 5%, or 6%?

The three-month average for job growth is 29,000.

That’s not growth.

That’s stagnation in a cheap disguise.

The Fed will cut rates. Markets will rally. Politicians will declare victory.

And Americans will keep losing their jobs—just at a slightly slower pace.

That isn’t a solution.

It’s managed decline.

Final Line

The unemployment rate sits at 4.3%.

In government speak, that’s “elevated.”

In human speak, it’s millions of families one paycheck away from disaster—waiting for a recovery that will arrive too late to matter.