Taxes are not for the Rich

The Regressive Lie

Summary: The United States tax system is a con dressed up as progressivism. On paper, brackets climb to 37 percent. In practice, billionaires pay less than nurses. They don’t take wages, they borrow against assets, live tax-free, and pass fortunes untouched through the step-up basis. Payroll and sales taxes crush workers while states like Florida bleed the poor with regressive levies. Corporations dodge billions offshore, small businesses get strangled, and enforcement has been gutted. Forty years of lobbying turned law into theft. Real reform—wealth taxes, capital gains as income, IRS funding—is simple. What’s missing isn’t the math. It’s the will.

We're told the United States has a progressive tax system. On paper, it's true. Brackets rise with income, topping out at 37 percent. The rich are supposed to pay more.

But paper is cheap.

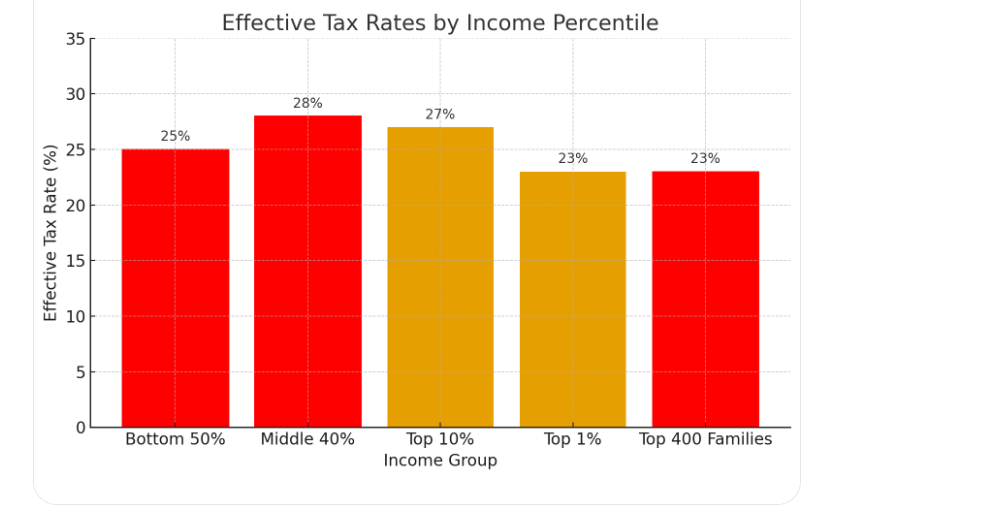

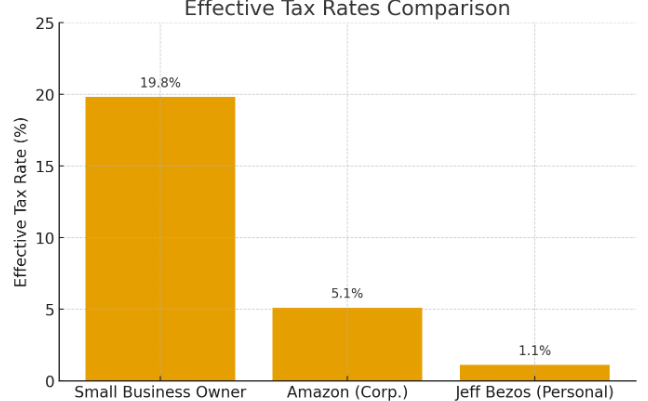

The richest 400 families in the country pay less tax, as a share of income, than the teachers who raise their kids, the cops who guard their gated compounds, the chauffeurs who drive their cars. Twenty-four percent on average, according to the White House Council of Economic Advisers. The richest people in the country pay less than the people who stock their shelves.

That's not progressivism. That's theft dressed as law.

The Billionaire Discount

The trick isn't complicated. Don't take wages. Wages are taxed.

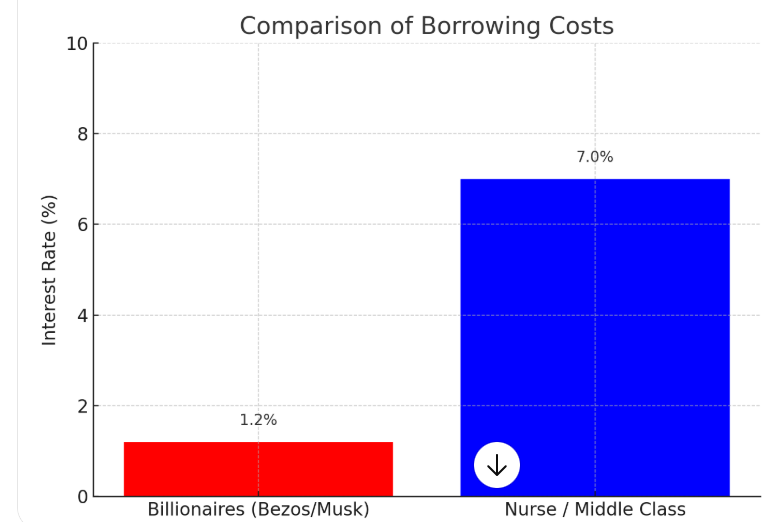

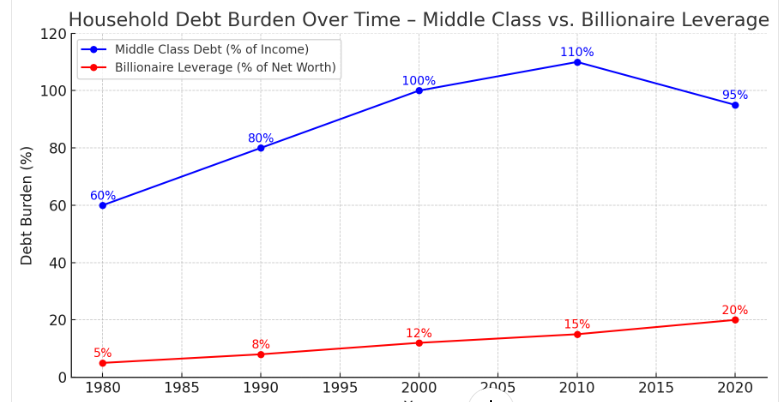

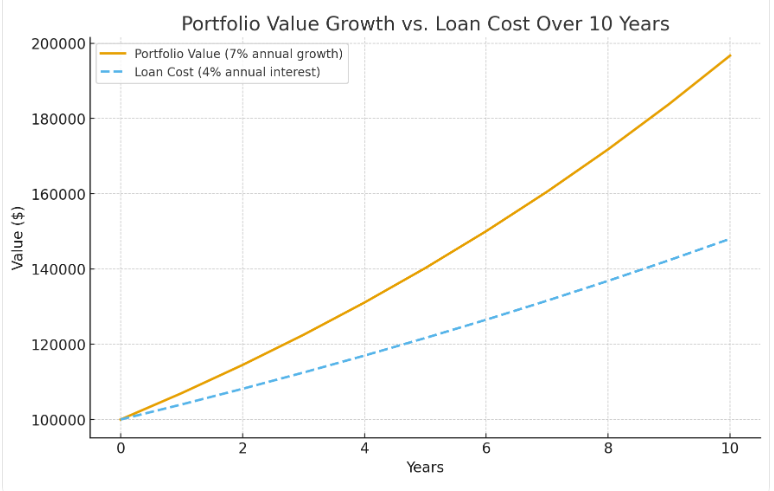

Instead, park wealth in stocks, bonds, and private companies. Let it sit. When you need cash, borrow against it. Bezos borrows billions at 1.2 percent interest—below the rate of inflation—while a nurse pays 7 percent for a mortgage and 22 percent on credit cards. Musk pledges Tesla shares for spending money. Their loans are secured by assets so enormous the banks practically pay them to borrow.

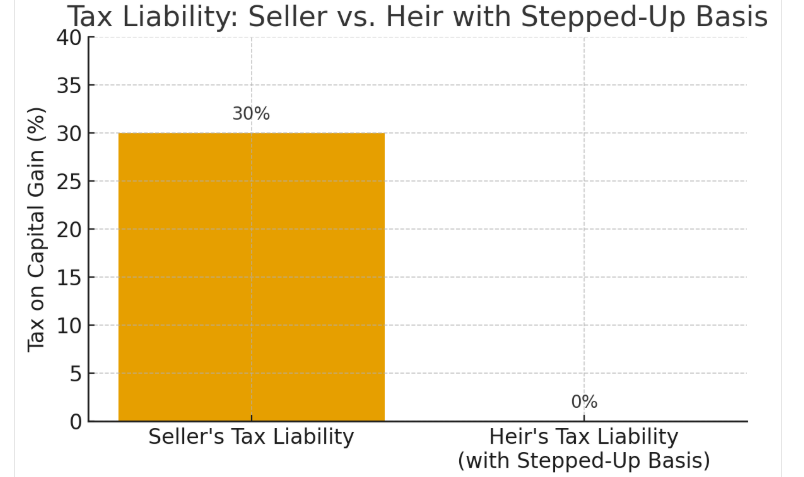

They live tax-free, then die with a "stepped-up basis" that erases the bill forever. The fortune passes untouched.

For the middle class, debt is a chain. For billionaires, debt is a fountain.

The Real Burden

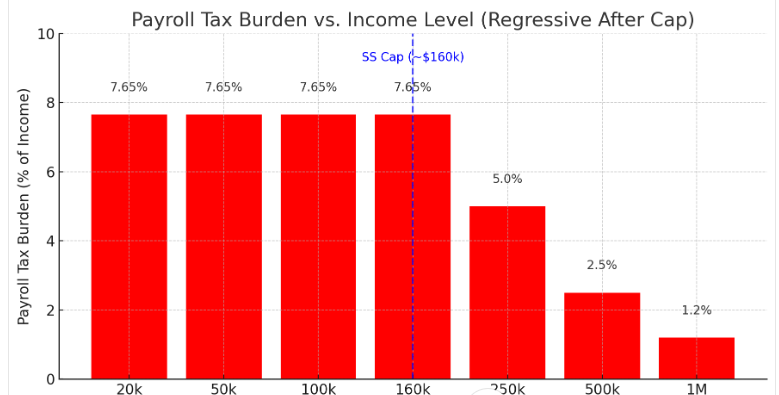

Payroll taxes bleed the working class dry. Social Security and Medicare taxes stop rising after $168,600 in wages. A CEO pays the same tax on their first $168,600 as the cashier pays on their entire income. After that, the CEO's burden falls to zero.

Sales taxes chew away at every grocery run, every gallon of gas. Property taxes hit every homeowner. Credit card rates hammer the families trying to cover rent and medical bills.

Add it up: nurses and teachers pay 30 percent. Billionaires, counting unrealized gains, pay closer to 8.

Workers pay more than owners.

State-Level Regressivity

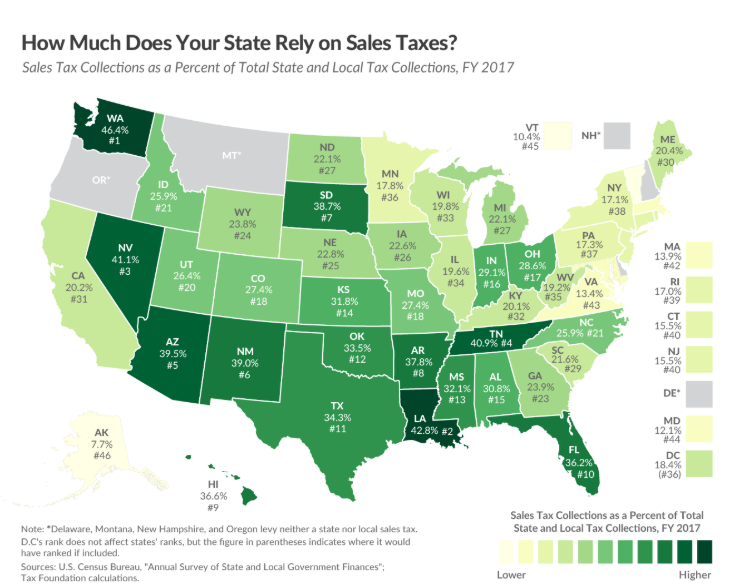

At the state level, the picture gets uglier. Nine states have no income tax at all. They balance their budgets on sales taxes and fees that fall hardest on the people with the least to spare. Florida's a paradise if you own a mansion on the beach. It's a racket if you work the counter at Publix.

The result: poor families give up as much as 12 percent of their income to state and local taxes. The wealthy? Closer to 7.

That's not progressive. That's regressive. By design.

The Corporate Black Hole

Amazon paid zero federal taxes in 2017 and 2018 on $11 billion in profits. Apple shuffled $300 billion through Irish subsidiaries to dodge $90 billion in taxes. Google runs the "Double Irish Dutch Sandwich"—revenue through Ireland, to the Netherlands, back to Ireland, then to Bermuda where the tax rate is zero.

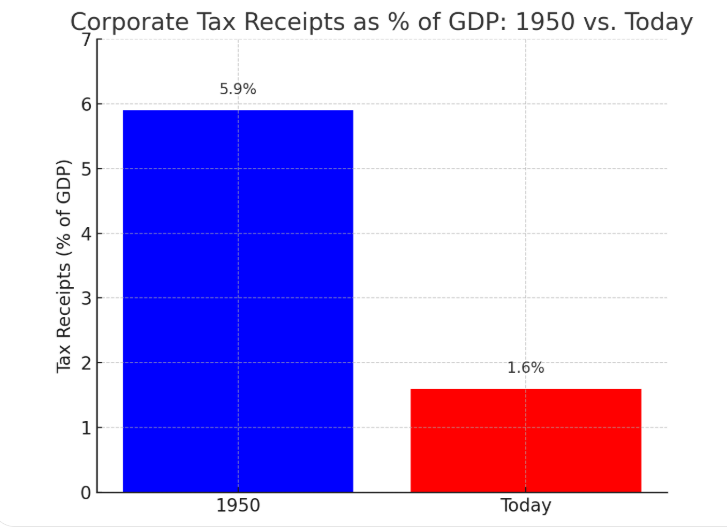

Since 1950, corporate taxes have plummeted from 30 percent of federal revenue to 6 percent. The Tax Cuts and Jobs Act of 2017—authored by Paul Ryan, blessed by McConnell, signed by Trump—slashed the corporate rate from 35 to 21 percent. Effective rate after loopholes? Eleven percent. Some years, nothing.

Trillions sit offshore in tax havens while bridges collapse in Pittsburgh.

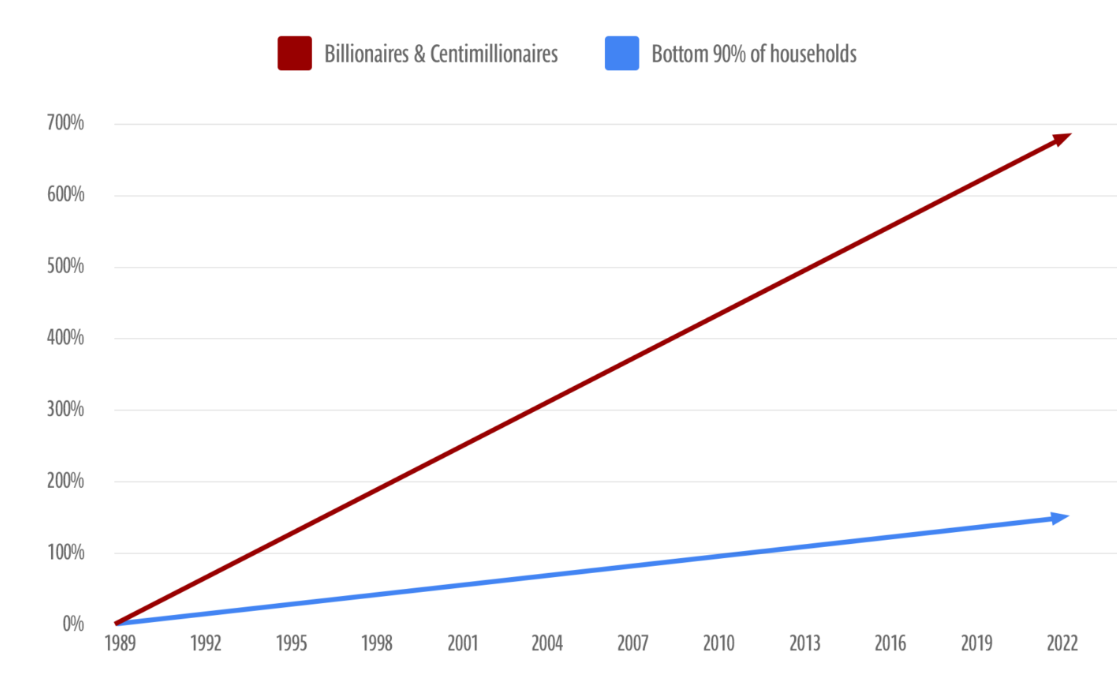

The Productivity Con

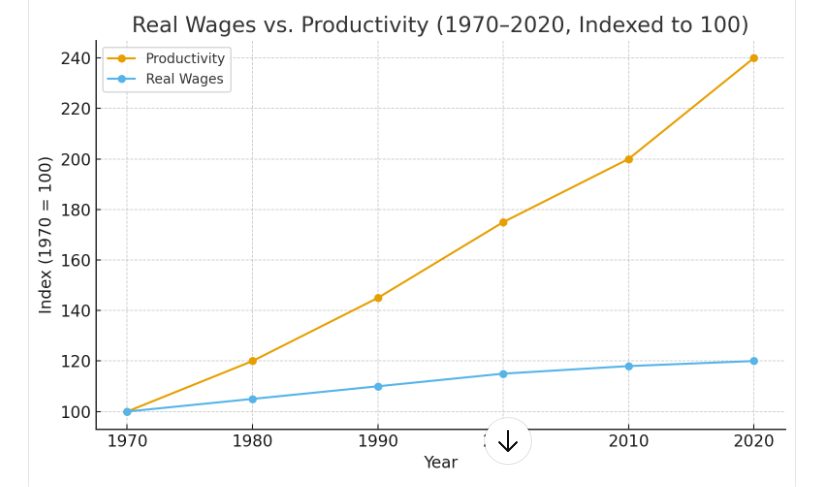

Since 1970, worker productivity has doubled. Wages haven't. Almost all of the growth has been skimmed by the owners of capital, shielded by a tax code built for them.

Every year since Reagan slashed top rates, the split has widened. Trickle-down didn't trickle. It pooled.

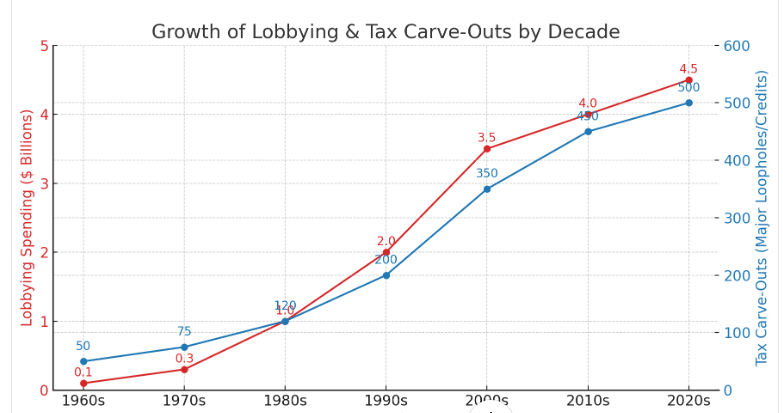

And every decade, lobbyists found new ways to carve the code.

The Estate Tax Extinction

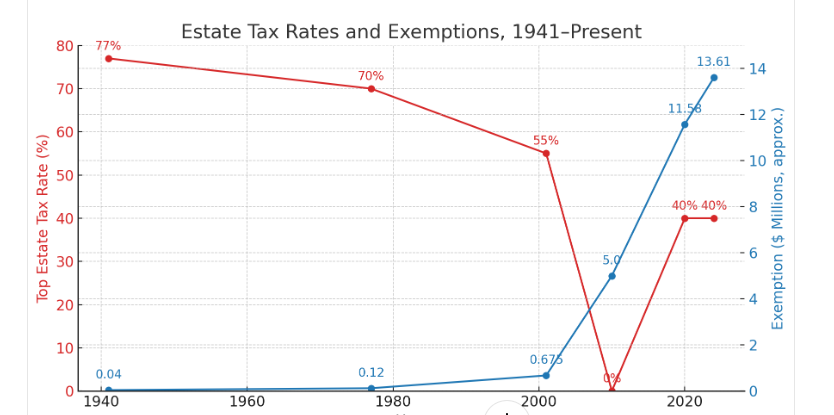

In 1941, estates over $10 million were taxed at 77 percent. Today? The first $27 million for a couple passes tax-free. Above that, 40 percent—if you're stupid enough to pay it. Smart money uses trusts, foundations, and "charitable" vehicles to dodge even that.

The Walton family has parked $250 billion in trusts that will never see a tax bill. Dynasty building while we pretend we're not feudal.

Forty Years of Engineering

This wasn't an accident. It took forty years of lawyers, accountants, lobbyists, and bought politicians to turn the tax code into a con. Each deduction, each carve-out, each lobbyist-written line tilted the system a little more. Capital gains rates slashed. Corporate loopholes widened. Enforcement gutted.

The architects have names. Steven Mnuchin, Trump's Treasury Secretary, made millions foreclosing on homeowners, then wrote the rules. Robert Rubin, Clinton's man, deregulated banks then collected $126 million from Citigroup. Hank Paulson went from Goldman Sachs to Treasury to bailout architect.

Both parties smiled, cashed the checks, and sold "growth." What grew was inequality.

The IRS Demolition

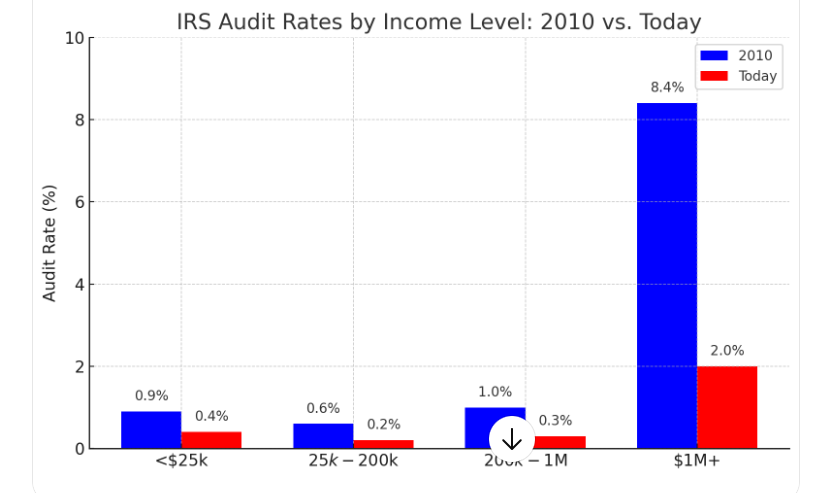

Since 2010, audit rates for millionaires have dropped 71 percent. The agency lost 30 percent of its enforcement staff—nearly 14,000 positions. Meanwhile, families claiming the Earned Income Tax Credit—making $25,000 a year—are audited at five times the rate of everyone else. Why? They're easy targets. No lawyers.

The Congressional Budget Office estimates unpaid taxes at more than $600 billion a year. That's nearly the size of the Pentagon's budget—vanishing not because people can't pay, but because the wealthy won't, and the IRS has been defunded into paralysis.

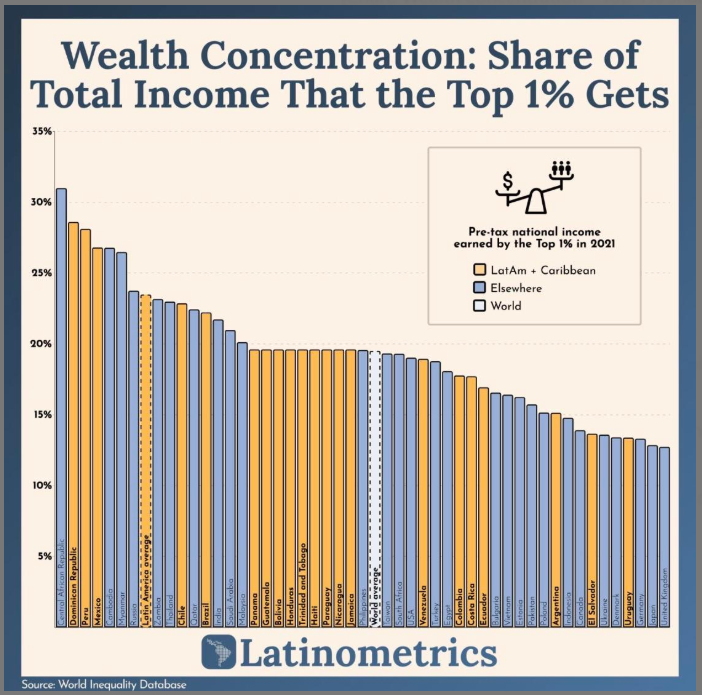

The International Mirror

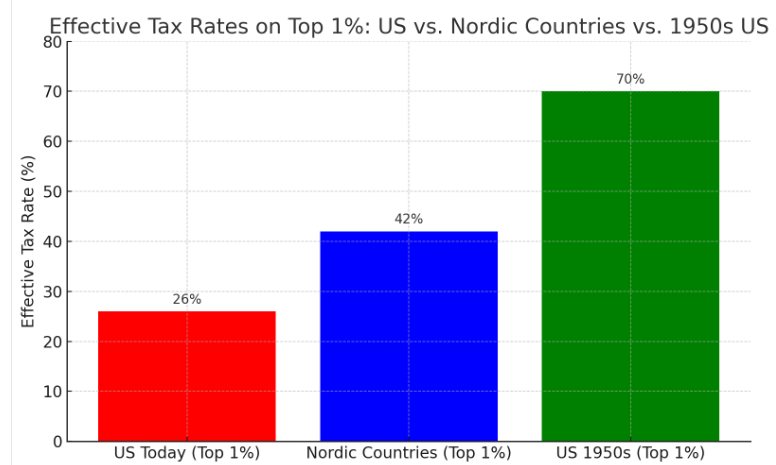

The United States isn't alone, but we're the worst among the wealthy. In Denmark, the rich pay 50 percent effective rates. In pre-Thatcher Britain, top marginal rates hit 83 percent. Under Eisenhower—that radical socialist—the top rate was 91 percent.

Today, we're closer to Russia's oligarchy than Sweden's democracy.

The Deficit Lie

We're told we can't afford healthcare. We can't afford housing. We can't afford childcare or infrastructure or schools. But the deficit is not a law of nature. It's a political choice.

For forty years, Congress starved the beast on one end and stuffed it on the other. Tax cuts at the top. Wars and subsidies and corporate bailouts at the bottom. The middle class gets the bill.

When billionaires skip out, the Treasury borrows. When the Treasury borrows, taxpayers pay interest. The con isn't just redistribution upward—it's a spiral of debt that binds the future.

The Fix

Real progressivity isn't complicated. It's just politically expensive.

Tax capital gains as income. Period. Money is money, whether it comes from a paycheck or a portfolio.

Kill the step-up basis. Death shouldn't be a tax holiday. Heirs can pay on what they inherit, same as anyone who works for a living.

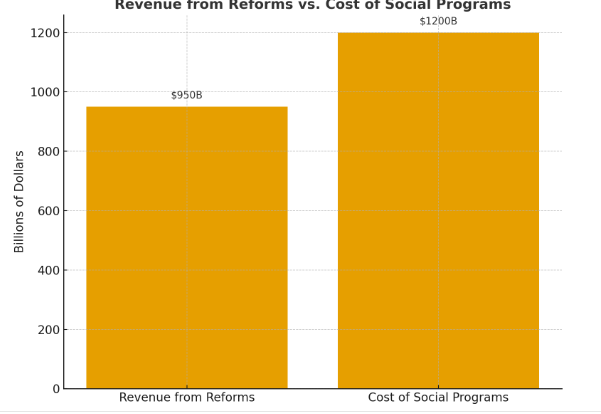

Wealth tax on fortunes over $50 million. Two percent annually. Three percent over a billion. Warren's plan would've raised $3 trillion over ten years. Enough to rebuild every bridge, fund universal pre-K, and still have change.

Close the borrowing loophole. If you borrow against assets over $10 million, it's a realization event. Pay the tax.

Lift the payroll cap. Social Security taxes should apply to every dollar, not just the first $168,600.

Minimum tax on corporations. Twenty-one percent, no exceptions, no deductions below that floor. You make money here, you pay taxes here.

Fund the IRS. Triple enforcement staff. Every dollar spent on auditing the wealthy returns six.

This isn't radical. It's what we had before the lobbyists rewrote the rules. It's what every other developed democracy still has in some form.

Theft by Another Name

The United States doesn't have a progressive tax system. It has a regressive lie.

A system where the mule pulls until it drops, while the owner rides in silk.

The mule's about dead. When it falls, the cart overturns. And the owners better hope they land soft, because history says they usually don't.

The fix is there. The math works. The money exists.

What's missing is the will to take it back.

Appendix I: How the Borrow, Spend, Die Strategy Works

The scheme is elegant in its simplicity, criminal in its effect.

Step One: Never Sell

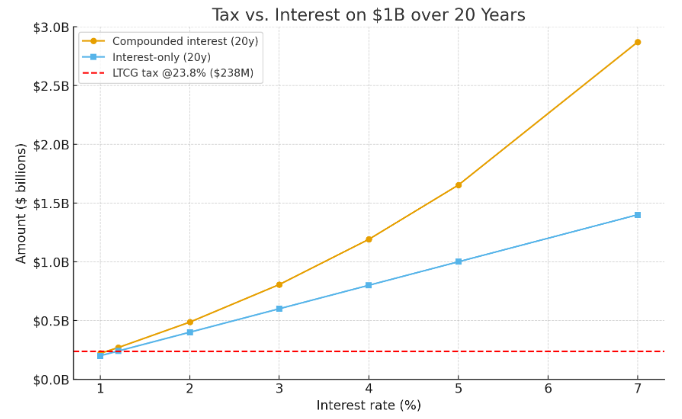

You own $10 billion in Amazon stock. If you sell, you trigger capital gains tax—20 percent federal, plus state taxes, plus the 3.8 percent investment income surcharge. Call it 30 percent all in. That's $3 billion to the government.

So you don't sell. Ever.

Step Two: Borrow Against It

Walk into any private bank—Goldman, Morgan Stanley, JPMorgan Private. Show them your portfolio. They'll loan you $5 billion at 1.2 percent interest. Sometimes less. The loan is secured by your stocks, which keep growing at 15 percent annually.

The math is pornographic. You're borrowing at 1.2 percent against assets growing at 15 percent. The spread is 13.8 percent. You're getting paid to borrow.

Step Three: Live Tax-Free

That $5 billion loan? It's not income. The IRS can't touch it. You buy the yacht, the jet, the seventh house. You fund the lifestyle. All tax-free.

Your interest payments? Deductible against any investment income you do have. The government subsidizes your borrowing.

Step Four: Borrow More

Your $10 billion portfolio is now worth $20 billion. Borrow another $5 billion. Pay off the old loan if you want, or just let it ride. The banks don't care—your collateral keeps growing.

This cycle repeats until you die.

Step Five: Die

Here's where it gets obscene.

When you die, your heirs inherit the stock. But they don't inherit your tax bill. The IRS "steps up" the basis to current market value. That $20 billion portfolio? Your heirs receive it as if they paid $20 billion for it. The $19.9 billion in gains you never paid taxes on? Erased. Gone. Like it never happened.

Step Six: Your Heirs Repeat

Your heirs can sell immediately, tax-free. Or they can start their own borrow-spend-die cycle. The dynasty builds, untaxed, generation after generation.

The Numbers

Take a real example. Larry Ellison, worth $150 billion.

Traditional approach: Sell $1 billion in stock for spending money. Pay $300 million in taxes. Keep $700 million.

Borrow-spend-die: Borrow $1 billion at 1.2 percent. Pay $12 million in annual interest (deductible). Keep the full billion. Let the portfolio grow. Die. Heirs inherit everything, tax-free.

Difference: $300 million in taxes versus $12 million in interest. The taxpayers lose $288 million. From one transaction. From one billionaire.

The Banking Accomplices

The banks aren't just enablers. They're architects. Securities-based lending is their fastest-growing profit center. Morgan Stanley manages $68 billion in these loans. Bank of America, $62 billion.

They create the products, lobby for the rules, and laugh to the vault.

Interest rates for the wealthy: 1.2 percent. Interest rates for workers: 7 percent mortgages, 18 percent credit cards, 29 percent payday loans.

The poor subsidize the rich even at the lending window.

Why It's Legal

Because the people who write tax law are either wealthy themselves or funded by the wealthy. The carried interest loophole survived Trump's "tax reform." The step-up basis survived Biden's "Build Back Better." It survives everything because the donors demand it.

Senator Ron Wyden proposed taxing unrealized gains for billionaires. Dead on arrival. Janet Yellen floated closing the step-up loophole. Buried in committee.

The politicians mouth "fairness" while cashing checks from the people running the scheme.

The Scale

The Federal Reserve estimates $5 trillion in untaxed gains sitting in portfolios right now. At current tax rates, that's $1.5 trillion in revenue—enough to fund the entire federal government for four months.

But it's never collected. It sits, grows, passes to heirs, and the cycle continues.

Breaking the Scheme

The fix is simple:

- Tax loans against securities over $10 million as realization events

- Kill the step-up basis entirely

- Mark-to-market taxation for portfolios over $100 million—pay taxes on gains annually, like property tax

The billionaires would scream. The banks would rage. The lobbyists would swarm.

Good.

The alternative is a tax system where work is punished and wealth is worshipped. Where nurses pay more than billionaires. Where the mule dies and the cart overturns.

The borrow-spend-die strategy isn't a loophole. It's a middle finger to everyone who works for a living.

Time to break their fingers.

Appendix II: The Inheritance Aristocracy

We don't call them aristocrats. We call them "entrepreneurs" forty years after they inherited their fortunes.

The Dynasty Builders

The Waltons control $250 billion. Not Sam Walton—he's been dead since 1992. His kids and grandkids, who've never stocked a shelf or worked a register. They collect $3 billion in dividends annually while Walmart workers qualify for food stamps.

The Mars family sits on $160 billion in candy money. Third generation. The Kochs—$120 billion split among heirs who inherited their father's oil refineries and political machinery. The Cargill-MacMillans—14 billionaires from one grain fortune.

These aren't job creators. They're dividend collectors. Trust fund parasites dressed as captains of industry.

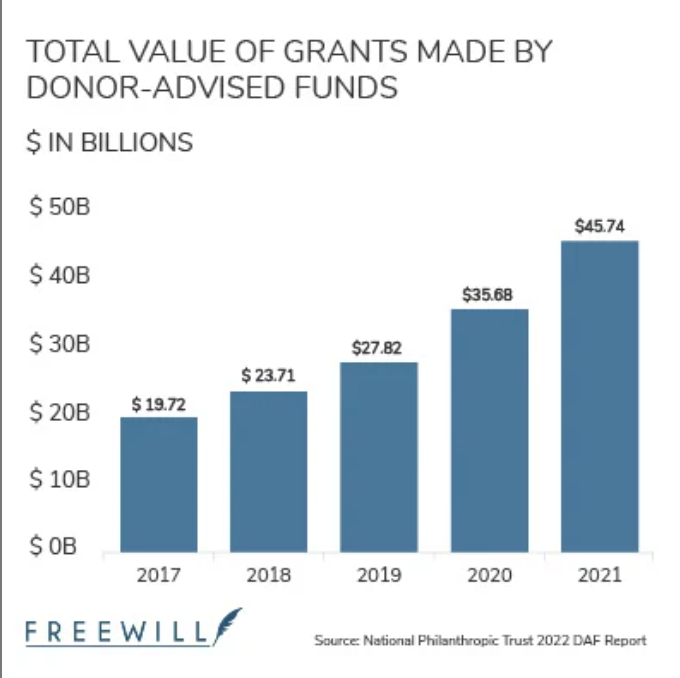

The Charity Charade

The tax code's greatest magic trick: turning greed into charity.

Mark Zuckerberg's "Chan Zuckerberg Initiative"—not a charity. It's an LLC. Full control, tax deductions, no oversight. Bill Gates' foundation—required to spend only 5% annually. The other 95% compounds tax-free forever.

Donor-advised funds are worse. Drop $100 million in, take the deduction immediately, then sit on it forever. No requirement to actually give it away. $230 billion parked in these vehicles, growing tax-free while the donors get naming rights on hospital wings.

The Sacklers put billions in offshore trusts before Purdue's opioid reckoning. The trust is "charitable." The charity? Their own family foundation. Tax-subsidized reputation washing for drug dealers in Armani.

The Small Business Massacre

While Amazon pays nothing, the corner hardware store pays 37% on profits plus 15.3% self-employment tax. Over 50% effective rate for a small business owner making $200,000. Jeff Bezos? Eight percent.

The tax code doesn't just favor the wealthy—it murders competition. Every loophole for the giants is a knife in the small operator's back. The local bookstore can't run profits through Ireland. The family restaurant can't claim accelerated depreciation on private jets.

This isn't market capitalism. It's tax-code feudalism.

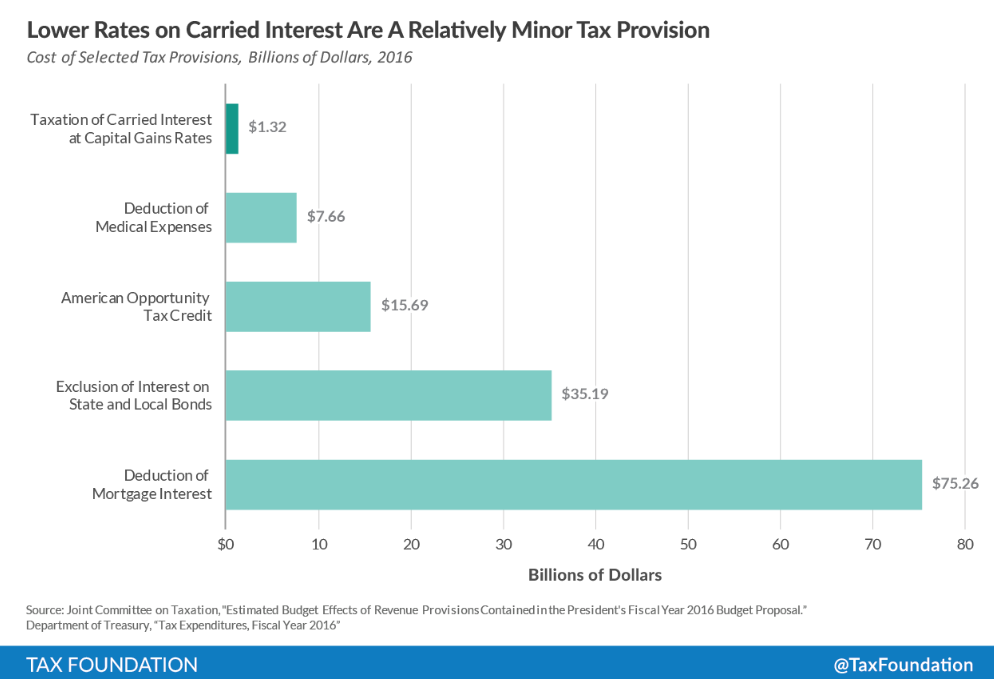

The Carried Interest Survival

Private equity managers still pretend their salaries are "capital gains." Twenty percent tax rate instead of 37. Every president since Bush promised to kill it. It survives.

Why? Because Stephen Schwarzman gave $35 million to Republicans in 2020. Ken Griffin dropped $65 million. They bought the loophole's survival for less than they save in a single year.

The managers aren't investing their own money. They're taking fees for investing yours. That's income. Every economist knows it. Every politician knows it. The loophole survives because the people who profit from it own the people who could kill it.

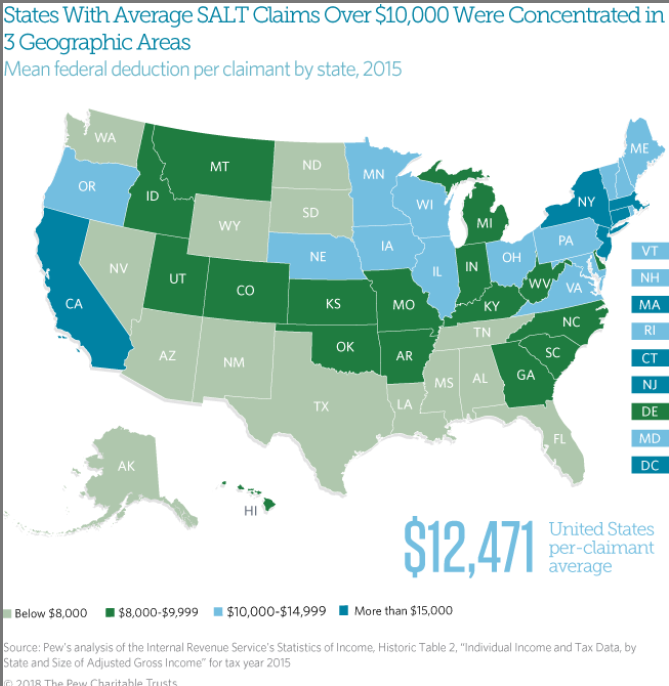

The SALT Cap Punishment

Trump's 2017 tax bill capped state and local tax deductions at $10,000. Not for corporations—they still deduct everything. Just for humans.

A calculated assault on high-tax blue states that fund their schools and infrastructure. New York, California, New Jersey—states that actually provide services—saw middle-class tax bills spike while corporations got a 40% rate cut.

Meanwhile, "business losses" remain unlimited. Trump personally claimed $73 million in losses to avoid taxes. But a teacher can't deduct more than $10,000 in property taxes on the house she can barely afford.

The Historical Betrayal

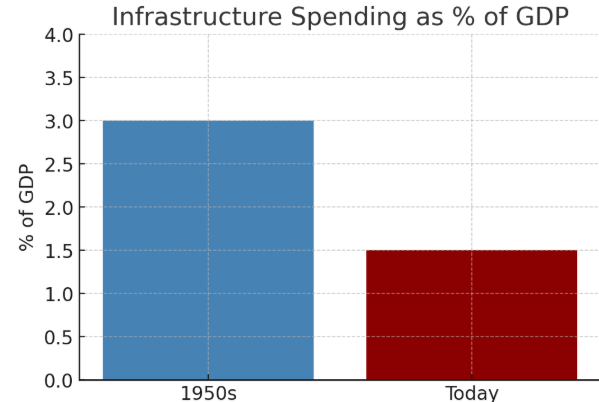

The tax system that won World War II is dead. Eisenhower's 91% top rate built the interstates, funded the Marshall Plan, created NASA, expanded universities, and constructed the greatest middle class in history.

That wasn't socialism. It was American pragmatism. The rich paid because the country had work to do.

Today's billionaires would've called Eisenhower a communist. They've convinced half the country that taxing wealth is theft, while the real theft happens every April 15th when workers pay more than owners.

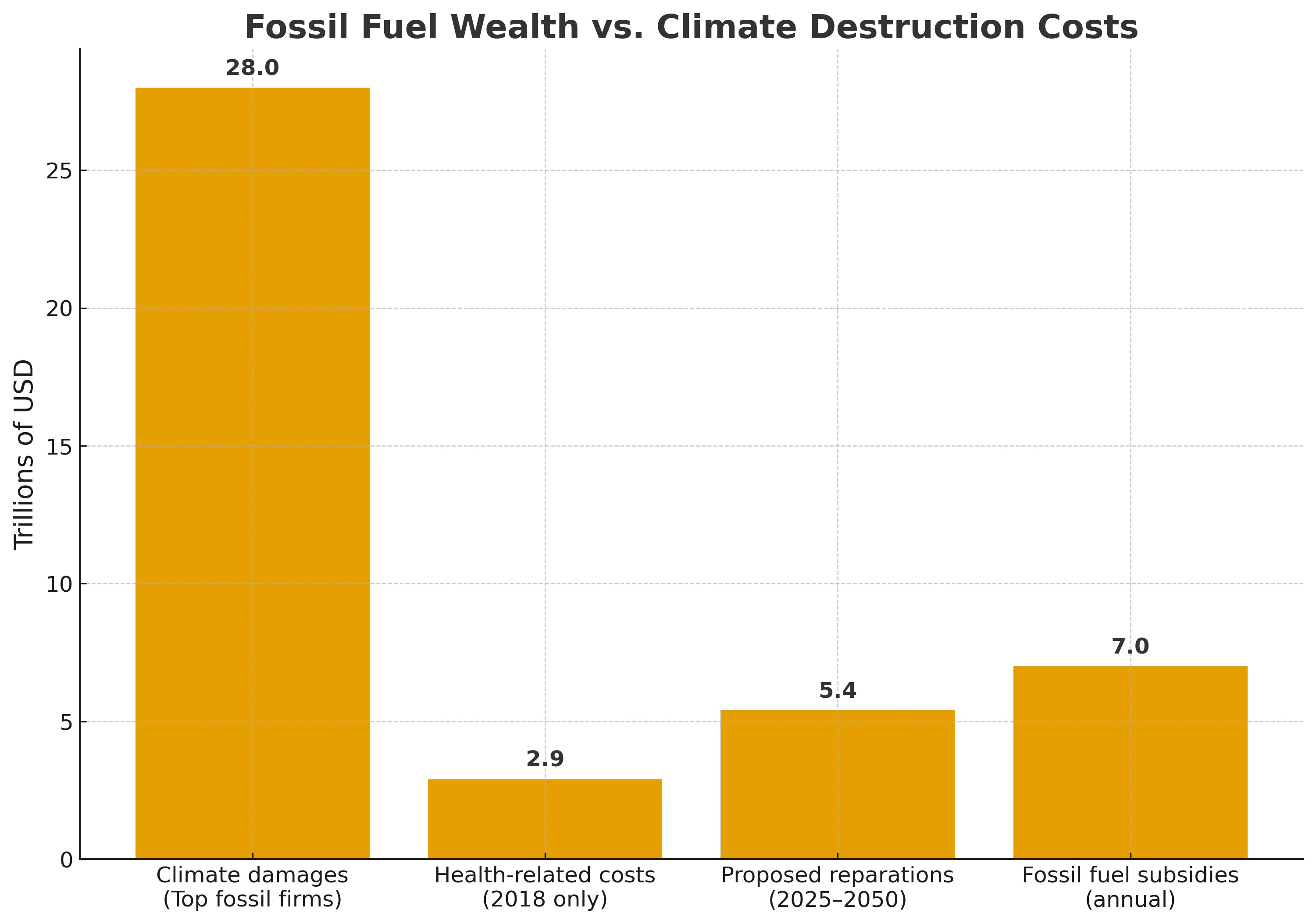

The Climate Connection

Every untaxed billion compounds the crisis. Fossil fuel fortunes grow tax-free while the coasts flood. The Kochs spend their untaxed inheritance funding climate denial. Oil executives borrow against appreciation they'll never pay taxes on, buying senators who kill carbon taxes.

The tax code isn't just unfair. It's suicidal. We're subsidizing the people burning the planet because they've purchased the people who could stop them.

Appendix III: What Real Reform Looks Like

Here's the blueprint they don't want you to see:

Immediate Reforms (Could Pass Tomorrow)

Securities-Based Lending = Realization Borrow over $10 million against stocks? That's a sale. Pay the tax. Simple legislation, massive revenue.

Kill Step-Up Basis Heirs inherit the tax bill with the fortune. Canada does it. Australia does it. Most of the developed world does it.

Minimum Corporate Tax - No Exceptions 15% floor, no deductions below that. If you claim profits to shareholders, you pay taxes on them. Period.

Restore Estate Tax Everything over $5 million per person, 50% rate. Over $50 million, 65%. Over $1 billion, 77%—Eisenhower's rate.

Structural Reforms (The Real Fight)

Wealth Tax 2% annually over $50 million. 3% over $1 billion. 5% over $10 billion. Constitutional amendment if necessary.

Mark-to-Market for Billionaires Portfolio worth more on December 31 than January 1? Pay tax on the gain. Just like property tax, but for stocks.

Financial Transaction Tax 0.1% on every stock trade. Kills high-frequency trading, raises $800 billion per decade.

Unitary Corporate Taxation Companies pay where they actually do business, not where they pretend to be headquartered. No more Bermuda mailboxes.

The Payoff

These reforms would raise $5 trillion over a decade. Enough for:

- Universal healthcare

- Free public college

- Paid family leave

- Modern infrastructure

- Green energy transition

With money left over.

The math works. Other countries prove it daily.

What's missing isn't money. It's spine.

The aristocrats know this. That's why they've spent forty years and billions of dollars making sure you don't.

Now you do.