Trickle This

Summary: Trickle-down economics was always a lie. The 1950s boom Republicans worship was built on a 91% top tax rate, strong unions, and public investment—policies they now sneer at as socialism. High taxes forced the rich to reinvest in planes built, factories expanded, workers paid. Reagan flipped it, slashing rates to 28%. The result wasn’t growth but hoarding—debt tripled, wages flatlined, inequality locked in. Trump repeated the scam with a trillion in buybacks. Kansas tried it and collapsed. History is blunt: high taxes circulate money; low taxes freeze it. Without progressive taxation, the middle class isn’t squeezed. It’s slaughtered.

Trickle-down economics was always a lie. Republicans pine for the 1950s—the golden years, they say—white fences, booming factories, fat middle-class wallets. They never mention the top marginal tax rate that built it: 91%. Ninety-one. Corporate taxes were high, unions were strong, government was laying down highways and schools. The very policies they sneer at now as “socialism” created the prosperity they still worship.

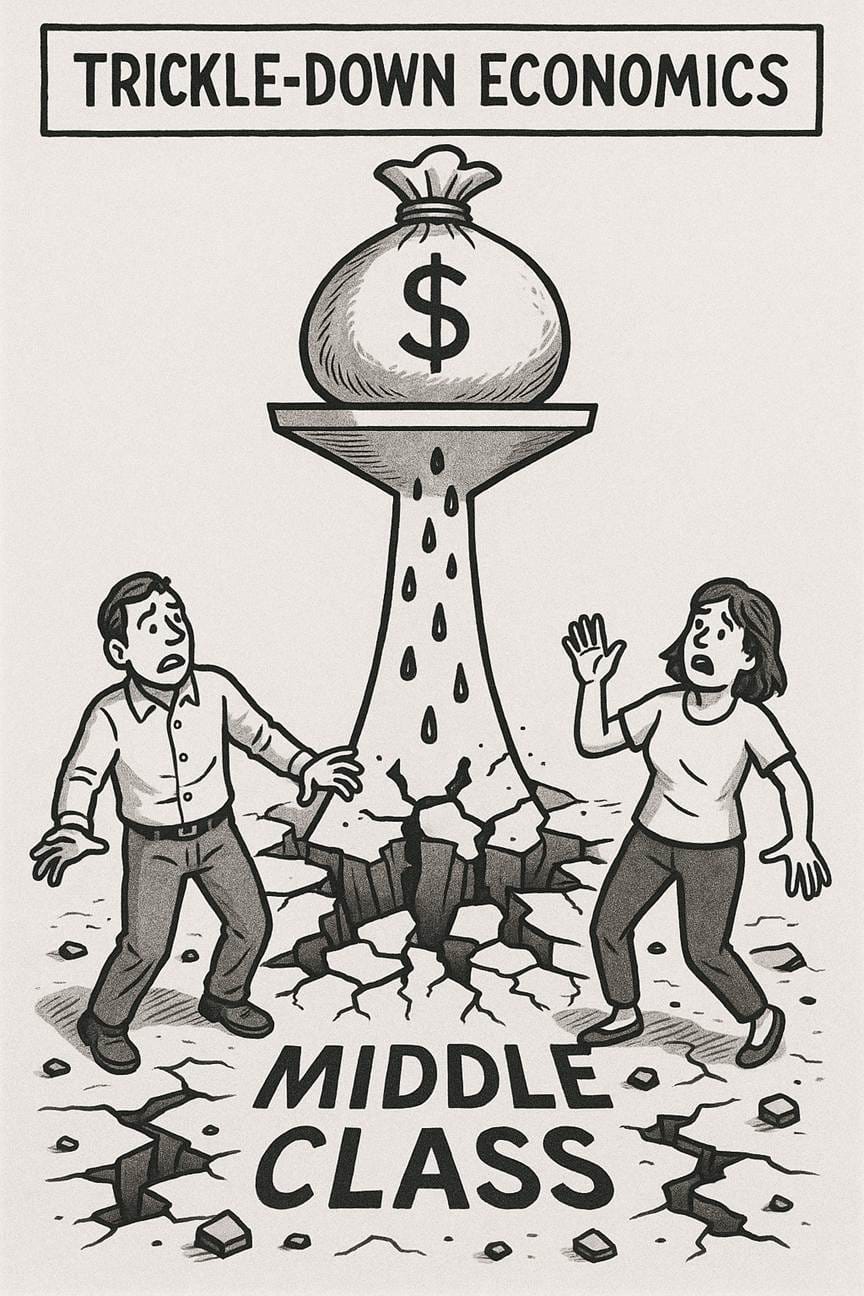

That was the formula: progressive taxation at the top, wages, and opportunity for the middle. It worked. Without it, the middle-class doesn’t just shrink—it gets destroyed.

Picture a businessman staring at a fat profit. If the tax rate is 91%, he has every reason to reinvest. Why hand it all to the IRS when he can buy something deductible? For just 9% more, the money is gone either way—but now he has a Learjet. Or a new plant. Or workers finally seeing raises. And those “vanity” jets weren’t just toys. They were jobs—engineers, machinists, upholsterers, techs, thousands of paychecks that turned into mortgages, groceries, school supplies. High taxes forced money into circulation.

Drop the rate to 28%, like Reagan did, and the pressure vanishes. No need to spend, no need to build. He pockets the cash, pays the small tax, and parks the rest offshore—or recycles it into stock buybacks. That’s what trickle-down got backward. Low taxes don’t unleash growth. They unleash hoarding.

Reagan promised jets, factories, raises. The workers got nothing. The debt tripled—from $900 billion to $2.6 trillion. Productivity rose 15%, but workers saw maybe 1%. CEOs made hundreds of times more. Inequality hardened into concrete.

The failure should have buried the myth. Instead, it became gospel. Bush cut taxes in wartime, torching Clinton’s surplus. Trump handed corporations permanent breaks in 2017, and they blew a trillion on buybacks. Kansas under Sam Brownback tried the purest version: slash and pray. Revenues collapsed, schools closed, roads crumbled, and even Republicans had to repeal it.

Seventy years of receipts prove it: when taxes are high, money moves—into jobs, into raises, into communities. When taxes are low, money freezes at the top. Bottom-up economics works. A waitress spends her raise tonight. A billionaire’s windfall just compounds. Guess which one grows the economy?

And yet here we are again. Trump repeats the swindle, and the hangars are empty. The workers are still out there—Wichita, Ohio, Pennsylvania—waiting for orders that never come. Instead they watch billionaires circle overhead while factories close and money disappears into accounts in the Caymans.

Without progressive taxation, the middle-class isn’t squeezed. It’s slaughtered.

Appendix: The Receipts

- Top Marginal Tax Rate (1950s): 91%

- U.S. GDP Growth (1950–1960): averaged ~4.2% annually

- Median Family Income Growth (1950s): doubled in real terms

- Federal Debt under Reagan (1980–1988): $900 billion → $2.6 trillion (tripled)

- Top Marginal Tax Rate under Reagan: cut from 70% (1980) to 28% (1986)

- Real Median Wage Growth (1980s): flat; productivity rose ~15%, wages ~1%

- Stock Buybacks after Trump’s 2017 tax law: $1 trillion in 2018 alone

- Kansas “Experiment” (2012–2017): revenues collapsed 25%, education and infrastructure gutted, policy repealed by bipartisan vote

The golden age of the middle-class was built on high taxes and reinvestment. Trickle-down gutted both—and the middle-class with it.